Understanding the Cash Tax Report

This article gives you an overview of our Cash Tax Report.

In this article, you'll learn how to navigate and understand our cash tax report.

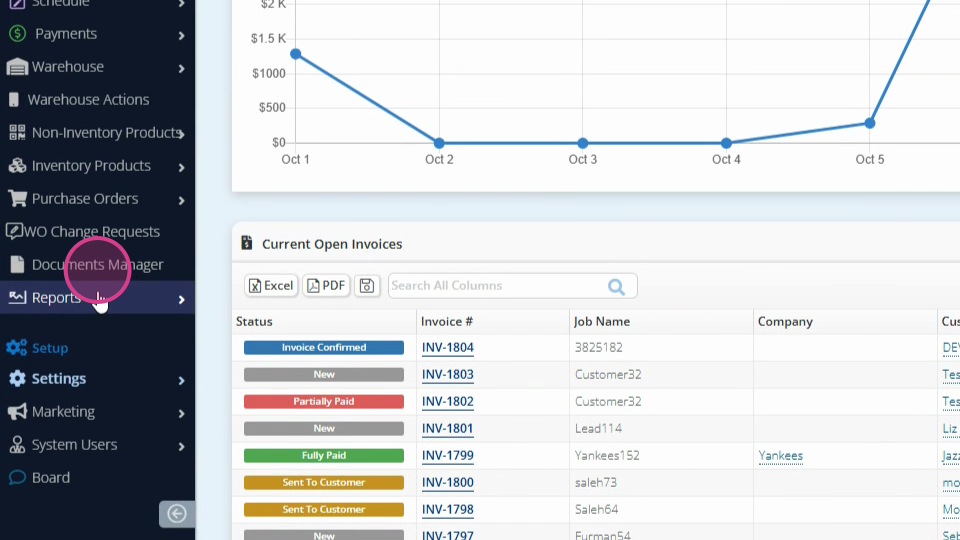

Step 1: Start by navigating to the cash tax report.

Step 2: Click on Reports.

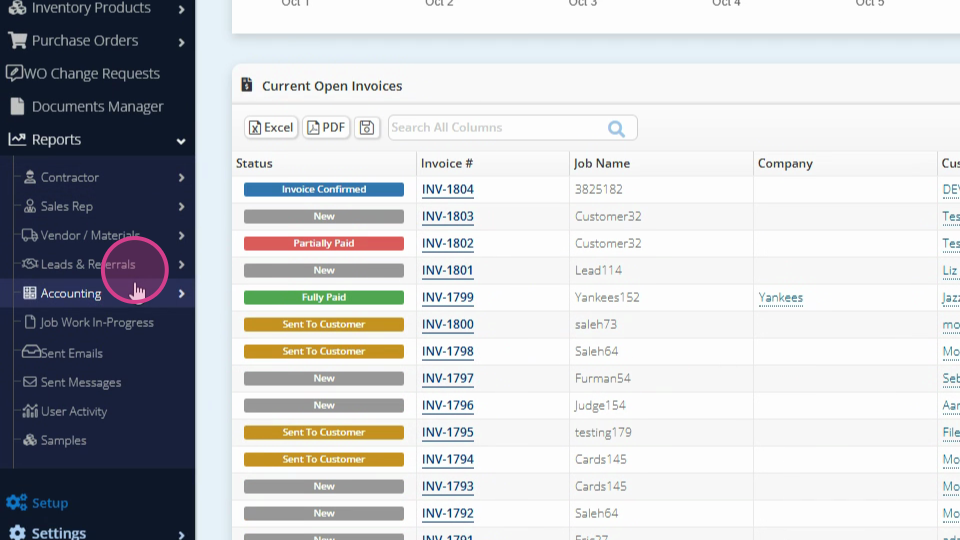

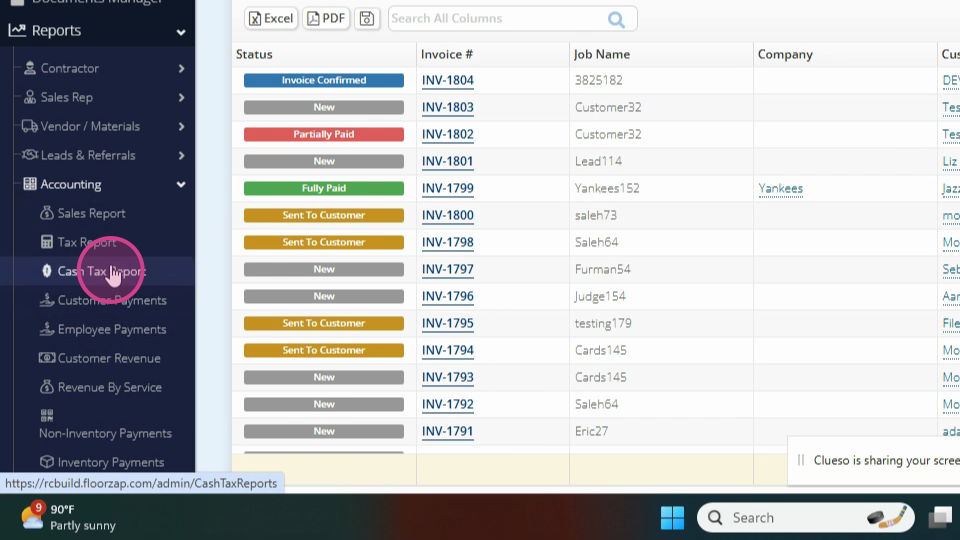

Step 3: Select Accounting, then Cash Tax Report.

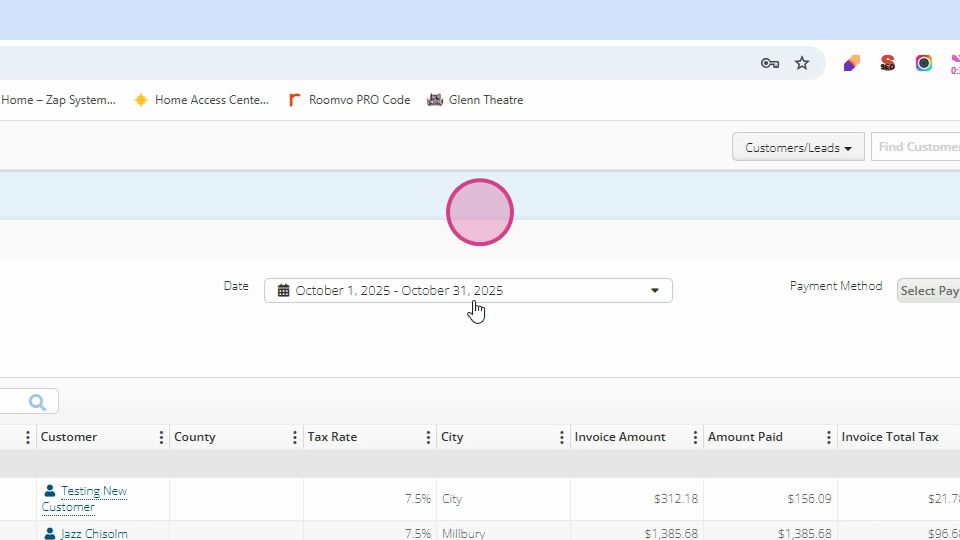

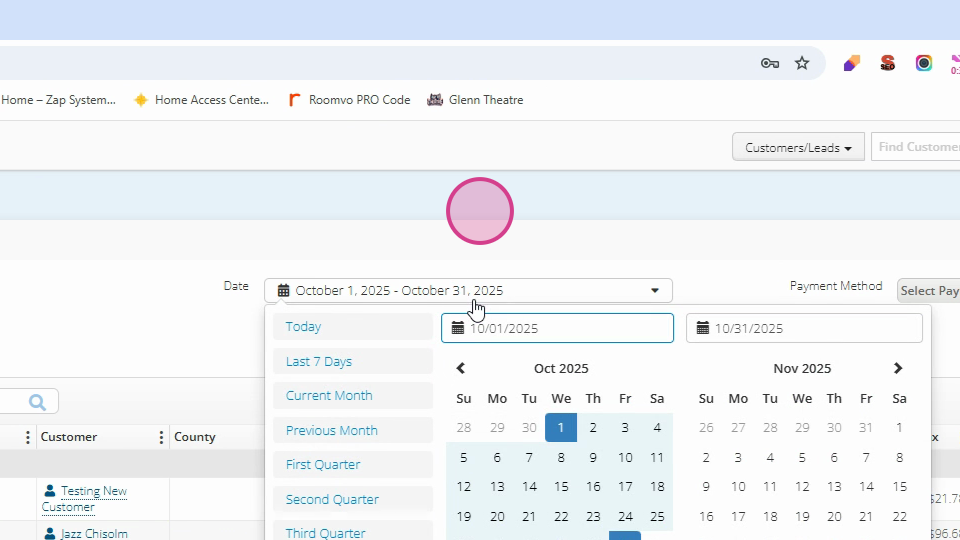

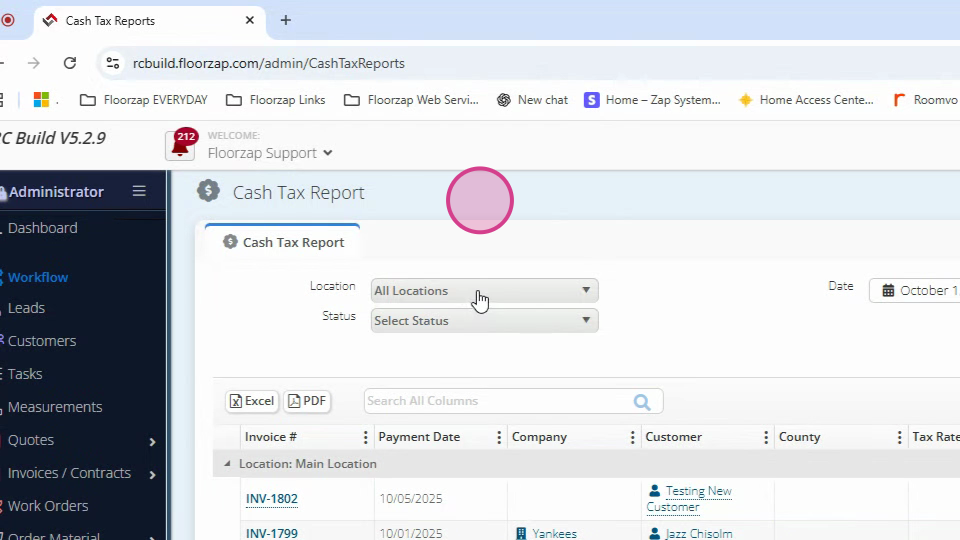

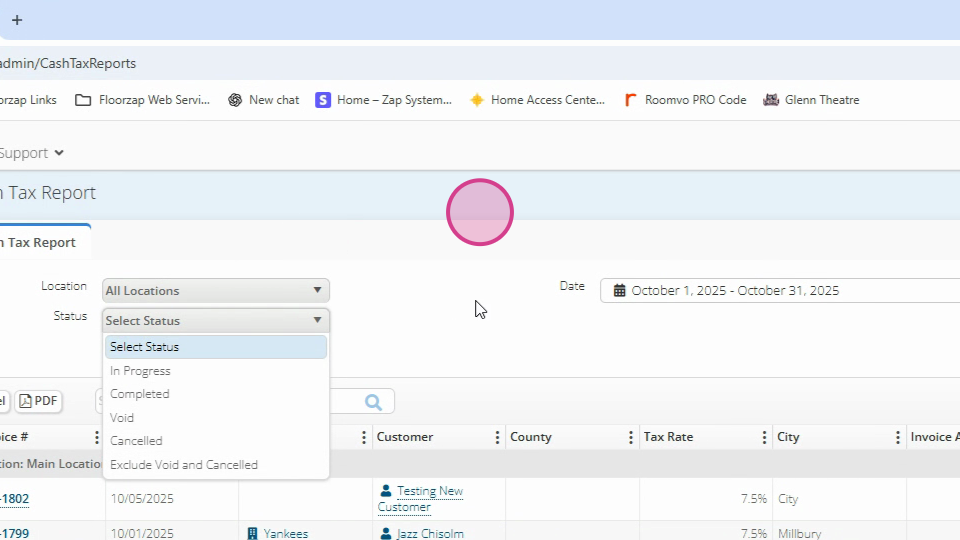

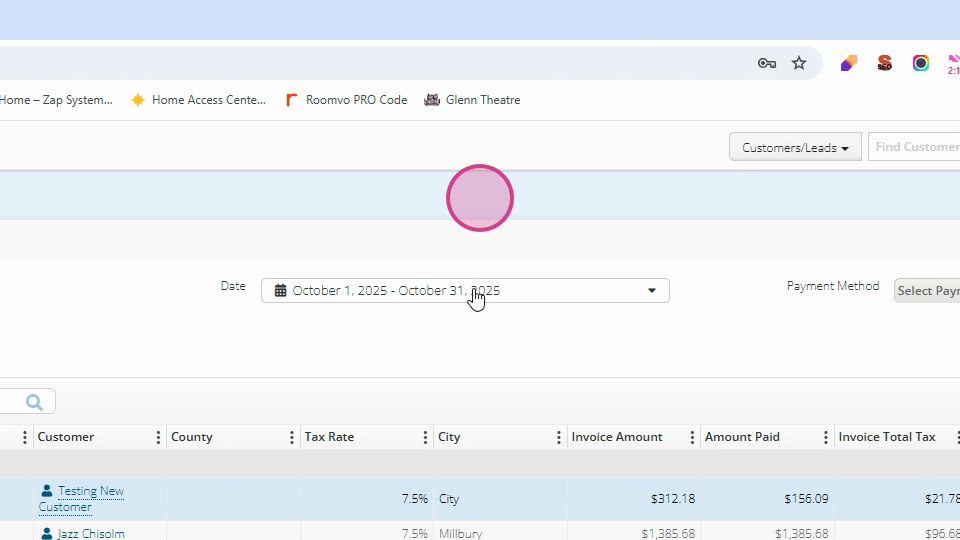

Step 4: Here, you'll see a list of invoices. The invoices you see here are invoices that had payments made during the date range indicated at the top of the page.

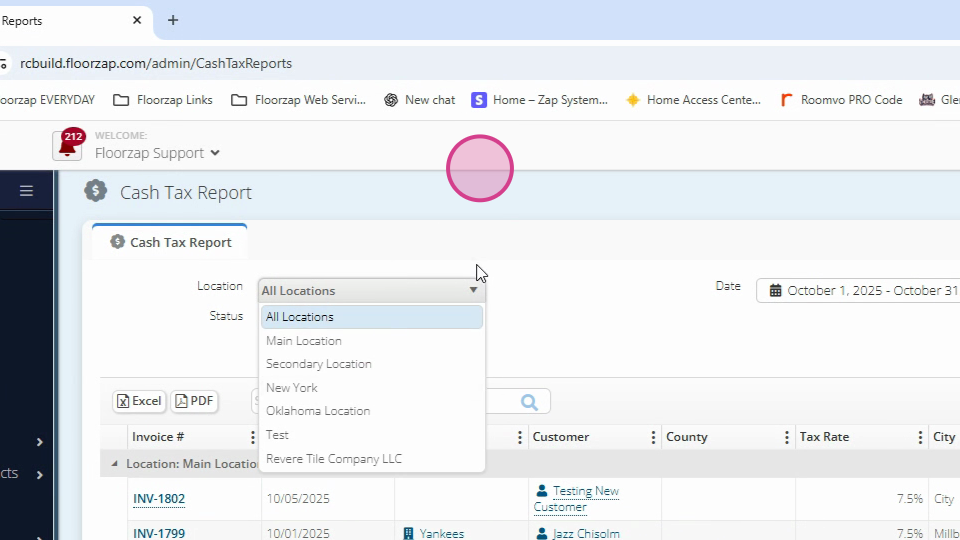

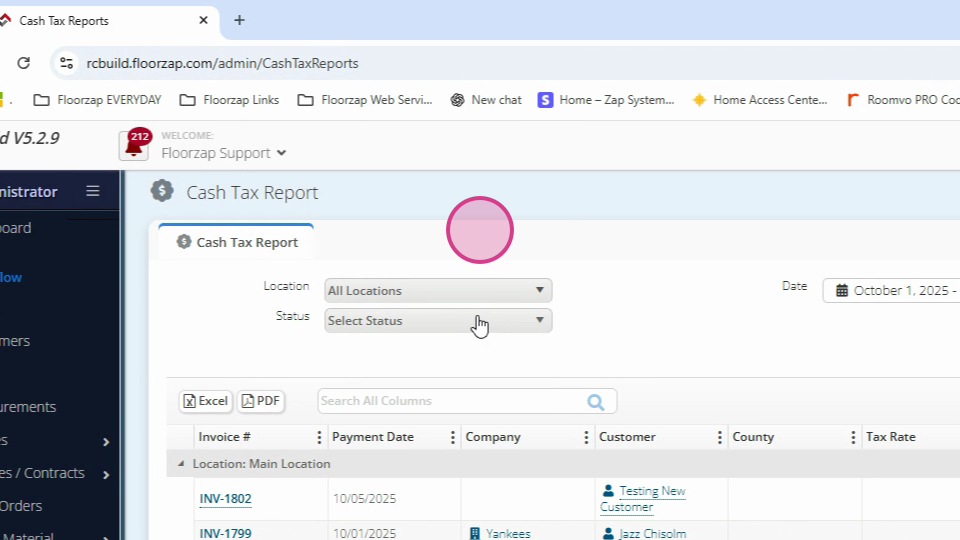

Step 5: You have the option to sort the list by location.

Step 6: You're also able to sort by status.

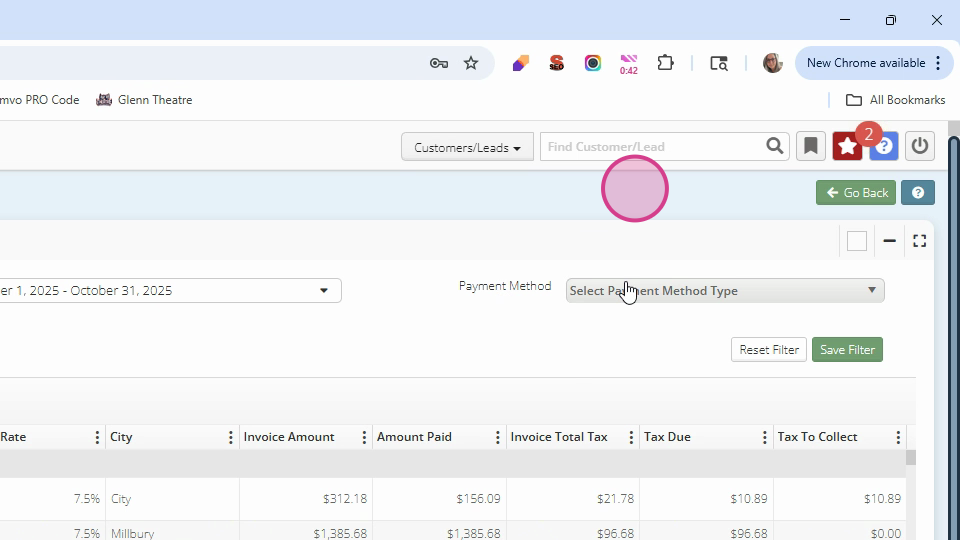

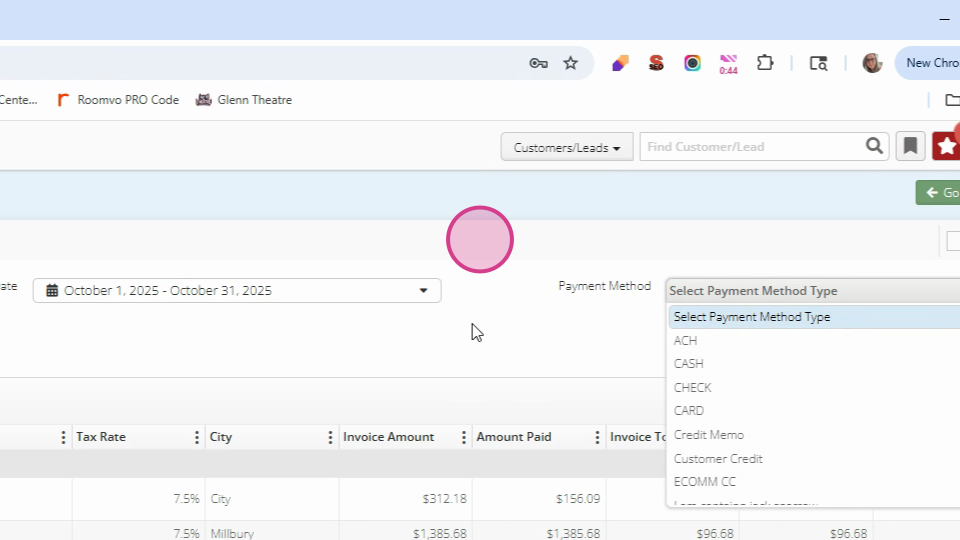

Step 7: And by payment method.

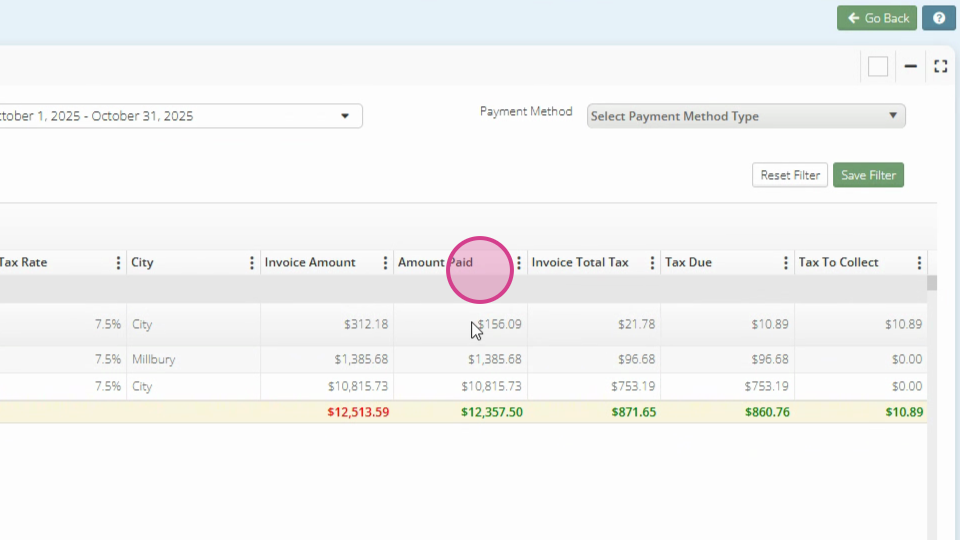

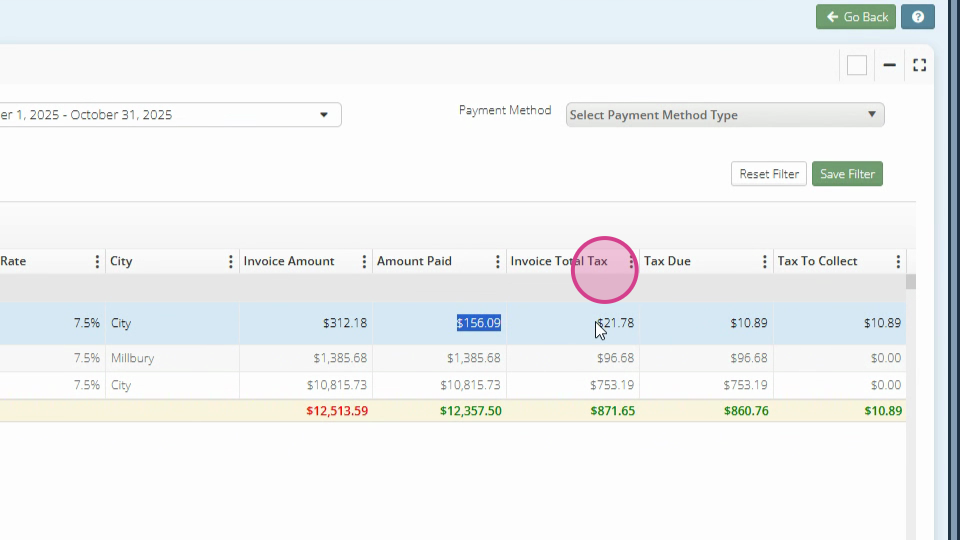

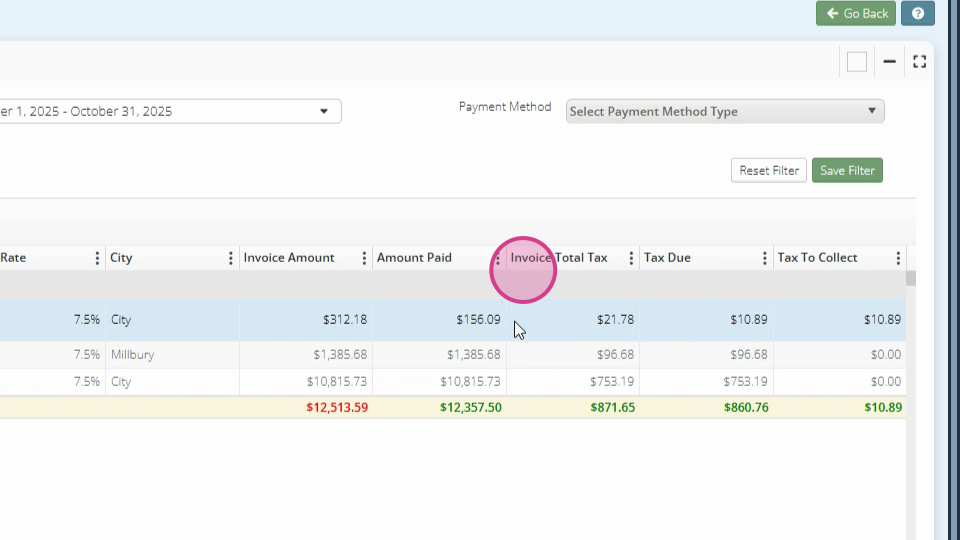

Step 8: The Invoice amount column shows the total invoice amount.

Step 9: The Amount paid column indicates how much was paid during this date range. Payments made outside of this range won't be reflected in this column.

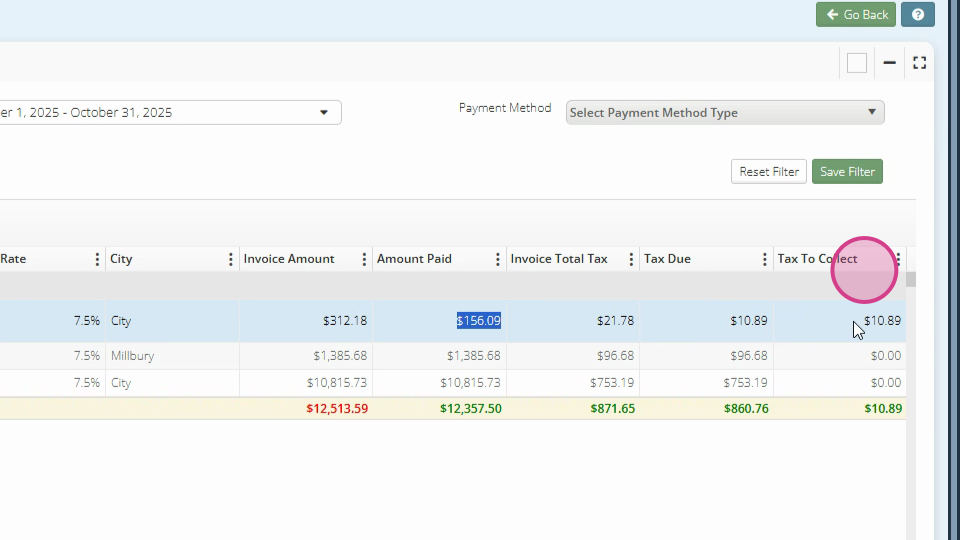

Step 10: The Total column shows the total invoice amount. The Total tax column shows the total tax for the entire invoice. The Tax due column reflects the tax for the amount paid. This is a percentage of the tax that is due for the total invoice.

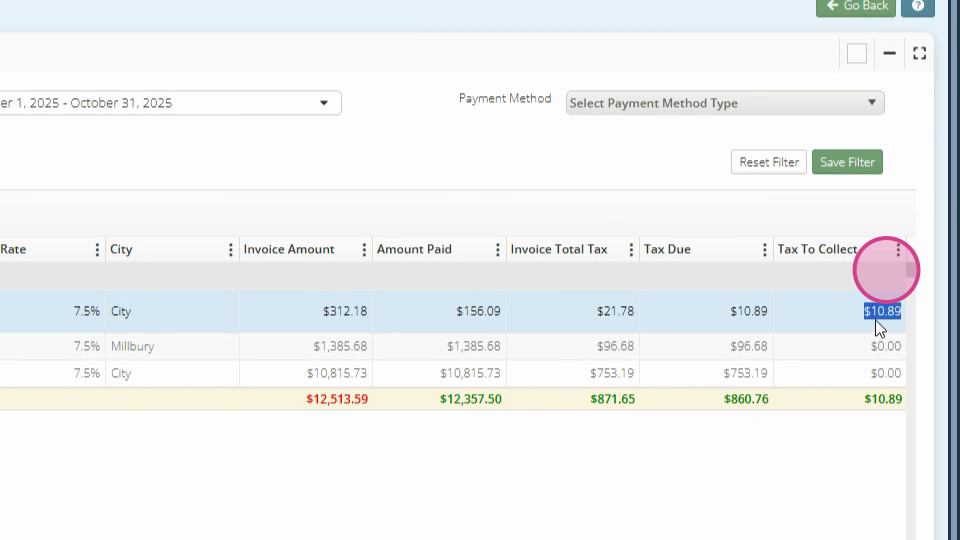

Step 11: The Tax to collect column shows how much tax you should collect during this date range. For example, if you're filtered for the current month, you'd be paying $10.89 on this job for the payment made on October 5, 2025.

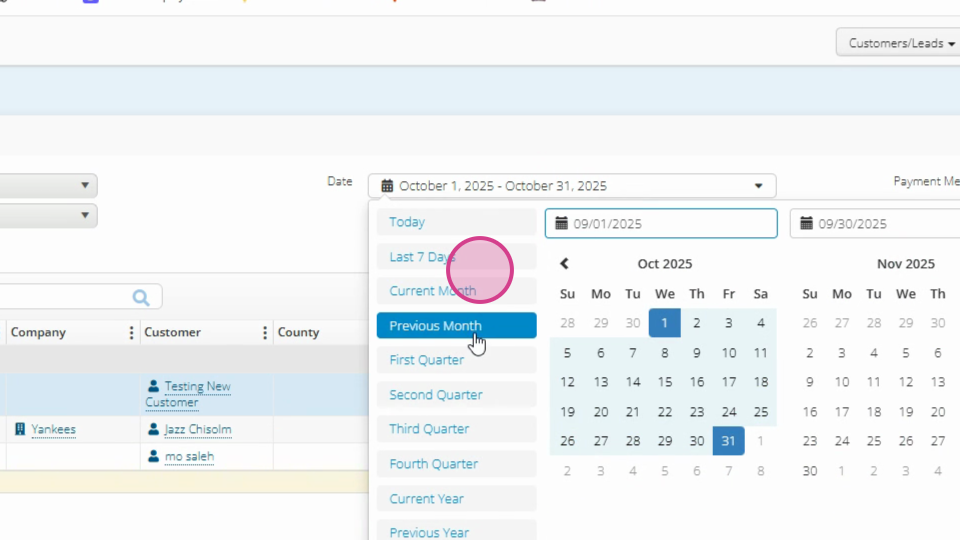

Step 12: If you go to the previous month, you'll see the list of invoices that were paid during this time period and how much tax is due and how much tax you should have collected.

We hope this guide helps you understand the cash tax report better.