How to Reconcile a Deposit with Floorzap Payments and Quickbooks Online

Learn how to use our payout summary in the merchant portal to batch a deposit and match it in QuickBooks.

This article will guide you through the process of reconciling your transactions in QuickBooks.

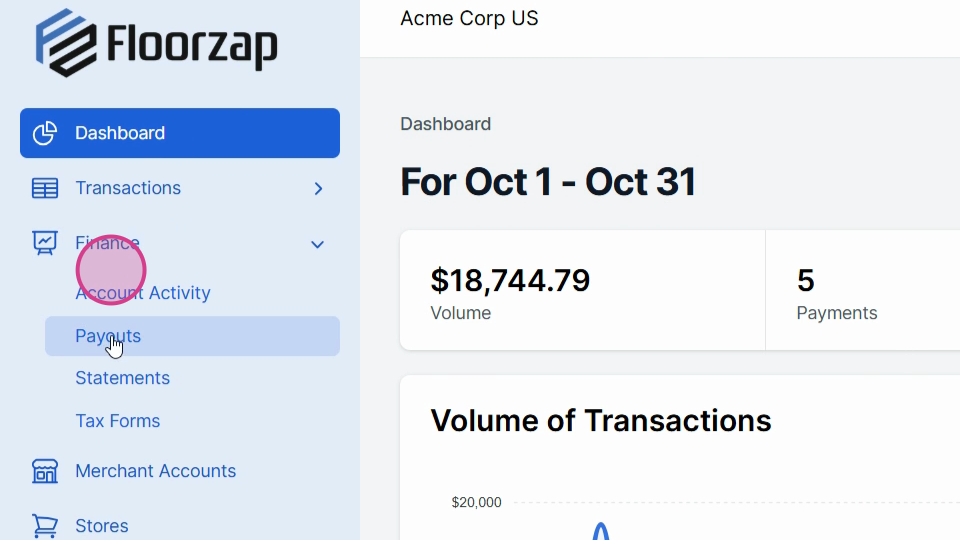

Step 1: Navigate to the merchant portal in QuickBooks. Select the finance then payouts option.

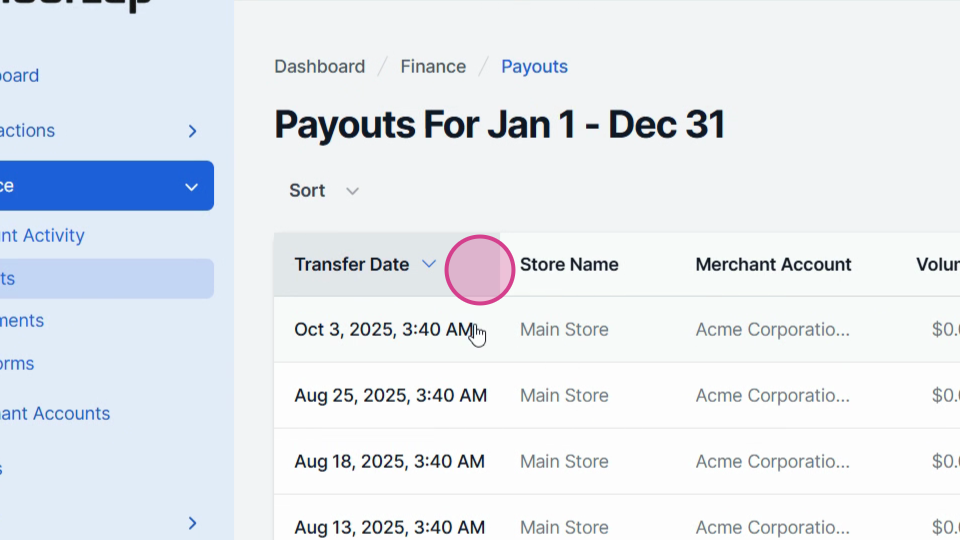

Step 2: A list of your recent batches will appear. Find the date for the batch you want to reconcile.

Step 3: Export the batch details to a CSV file. This file will contain all the transactions in the batch and their amounts, including the processing fee. This information will help you identify the payments in the current batch.

Step 4: In the merchant portal, you'll find the payout summary. Use this to reconcile the transactions in QuickBooks and match them to the bank deposit.

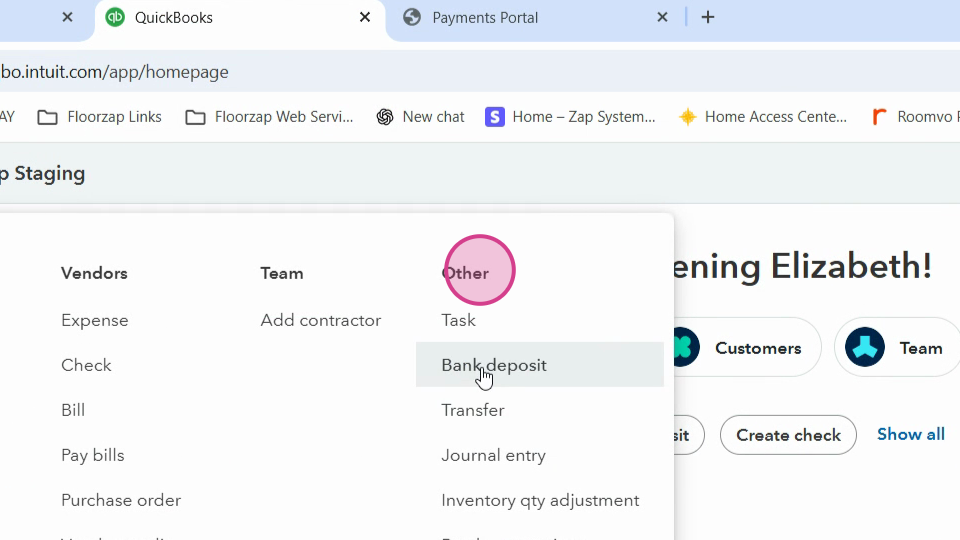

Step 5: Go back to QuickBooks and create a new bank deposit.

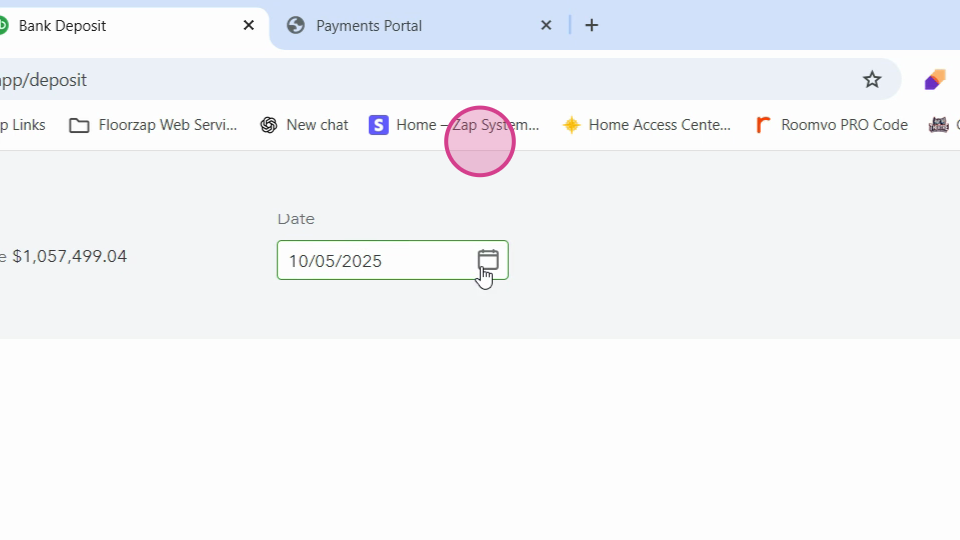

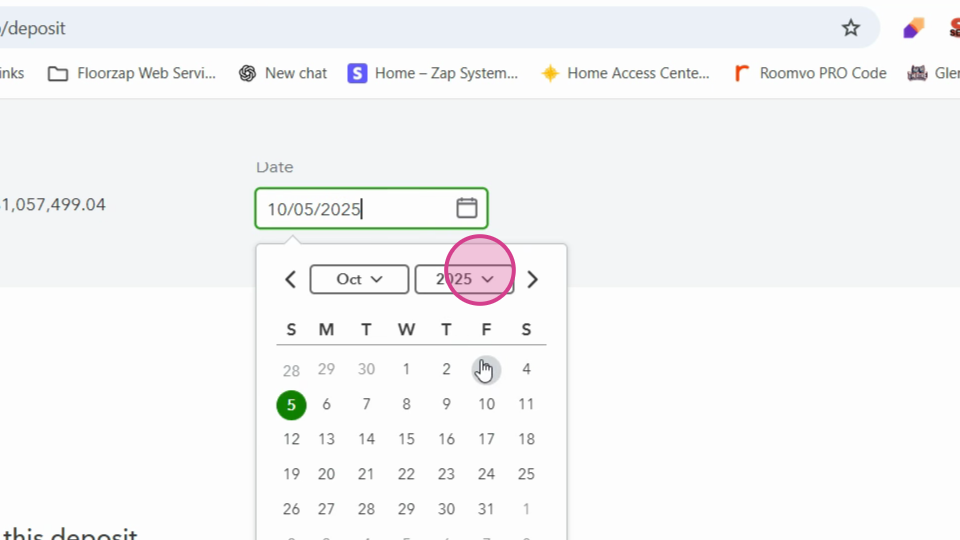

Step 6: Ensure your account name

and date

are correct.

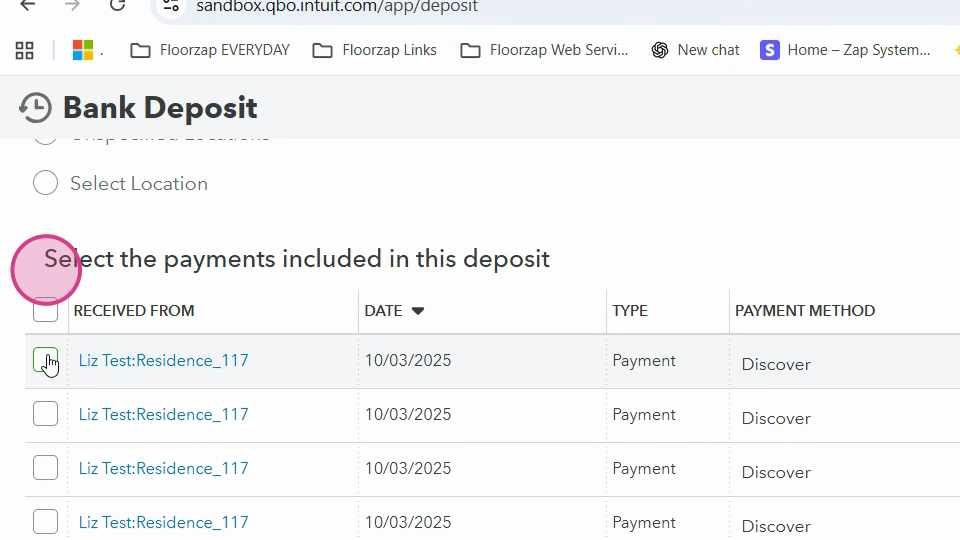

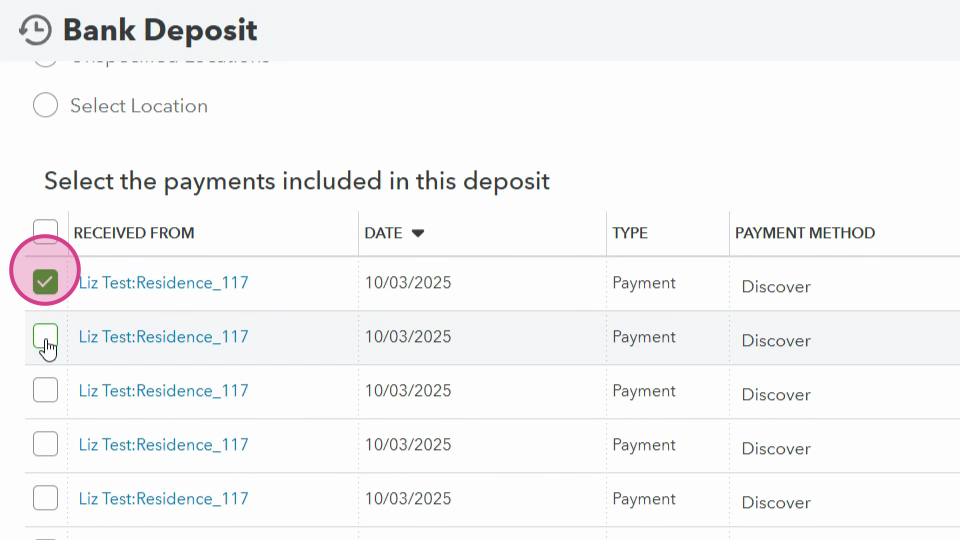

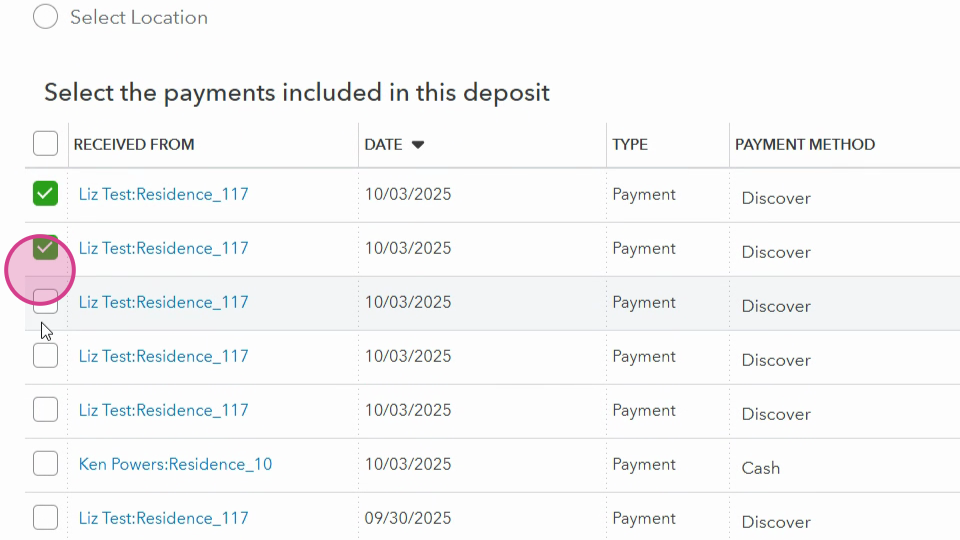

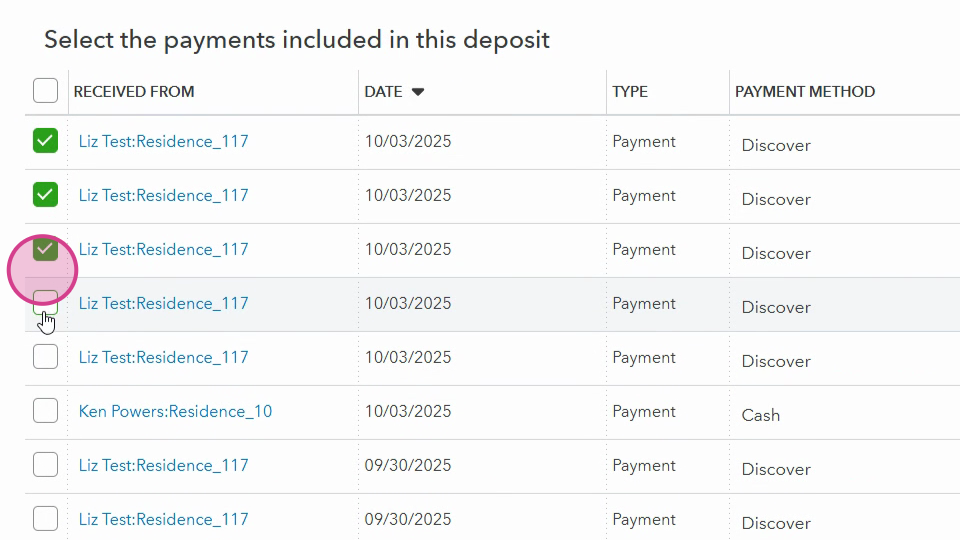

Step 7: Compare the amounts in the amount column with the amounts in the exported CSV file. In this example we have five transactions listed, select those five transactions in QuickBooks.

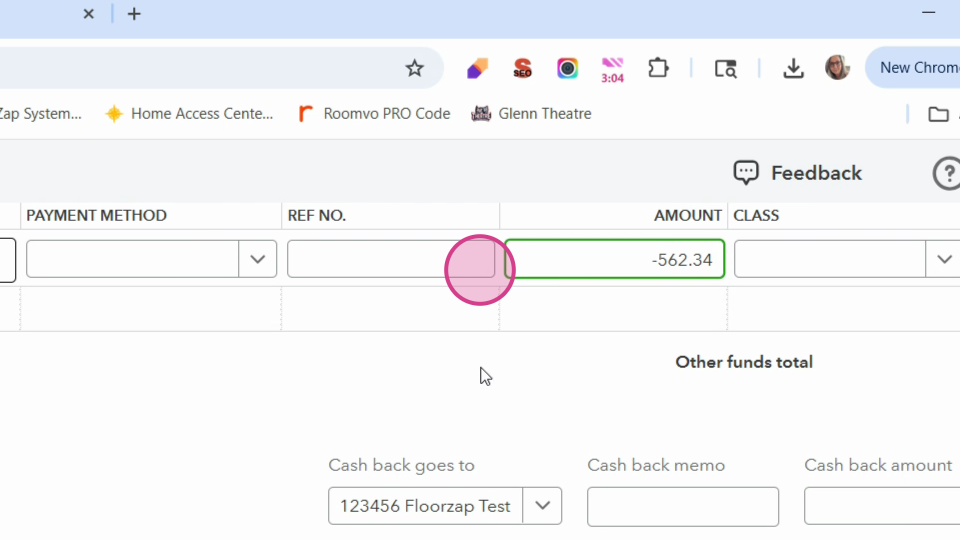

Step 8: After selecting the transactions, you'll see a deposit amount. This is the total payment volume for this batch. To match the deposit with the actual bank register, input a negative transaction amount in the transaction fees section. For instance, if the transaction fee is $562.34, input it as a negative amount.

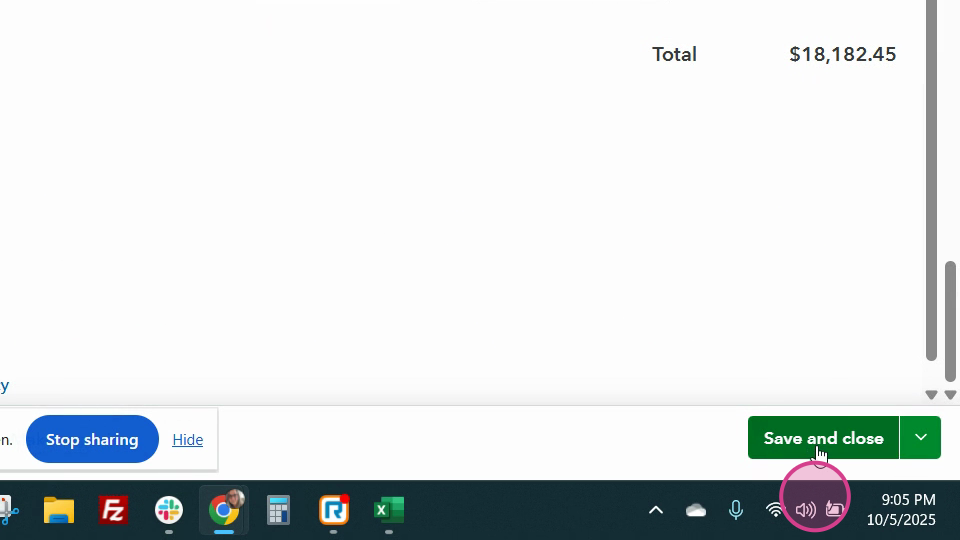

Step 9: Adding this negative amount will adjust your bank deposit to match the net settlement amount. Once done, hit save and close.

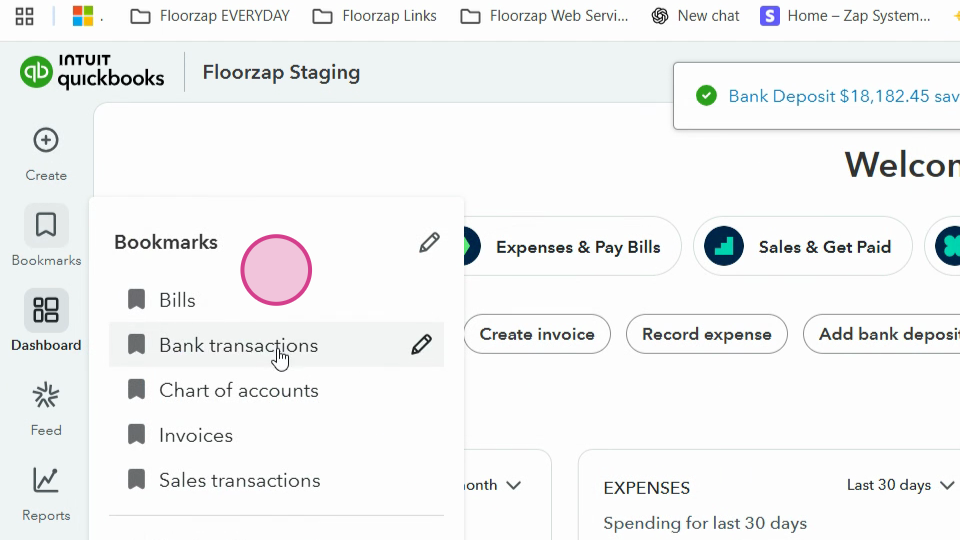

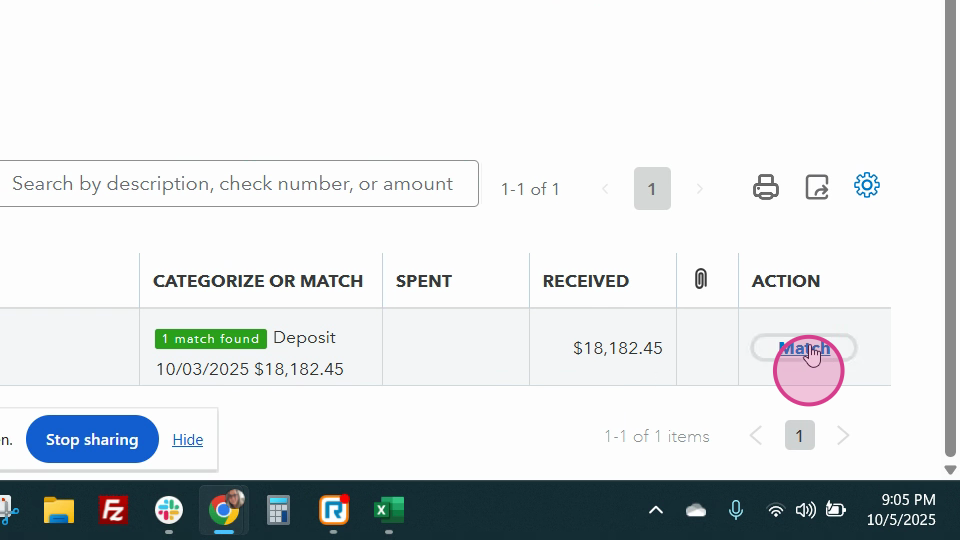

Step 10: Navigate to bank transactions. You should see that your deposit matches the amount of undeposited funds you had previously.

Step 11: Finally, match the deposit to complete the reconciliation process.

And that's it! You've successfully reconciled your transactions in QuickBooks.